What is RSI Divergence?

Before knowing RSI Divergence, we will first understand about RSI. The Relative Strength Index (RSI) is a popular technical analysis indicator used by traders to identify overbought and oversold conditions in the market. However, the RSI can also be used to identify divergence, which can signal potential trend reversals.

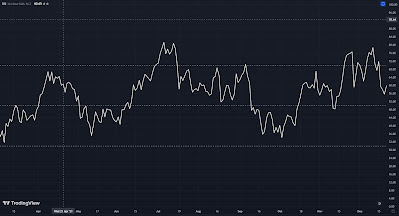

|

| Relative Strength Index(RSI) Indicator |

In this article, we'll discuss the RSI divergence strategy and how it can be used to make profitable trades. RSI divergence occurs when the RSI indicator moves in the opposite direction of the price action. This can signal a potential trend reversal or a change in momentum.

RSI divergence can be categorized into two types:

1)Bullish divergence

2)Bearish divergence.

1)Bullish divergence occurs when the price of an asset is making lower lows, but the RSI is making higher lows. This indicates that the momentum of the downtrend is slowing down, and a potential reversal to the upside may be in the cards.

2)Bearish divergence is observed when the price of an asset is rising and making new highs, but the RSI indicator is failing to confirm the new highs and is instead making lower highs, indicating a weakening trend. This indicates that the momentum of the uptrend is slowing down, and a potential reversal to the downside may be coming.

However to use RSI Divergence in trading, traders typically wait for the divergence to occur and then enter a trade in the opposite direction of the trend. For example, if there is a bullish divergence, traders may look to enter a long position, expecting the price to reverse to the upside. Conversely, if there is a bearish divergence, traders may look to enter a short position, expecting the price to reverse to the downside.

Traders often use other technical analysis tools to confirm the RSI divergence, such as trendlines or moving averages. They may also use other indicators to confirm the potential reversal, such as the MACD or the Stochastic Oscillator.

No comments:

Post a Comment